* The bronze plan had a coinsurance fee while the silver plan had

a flat fee copayment amount.

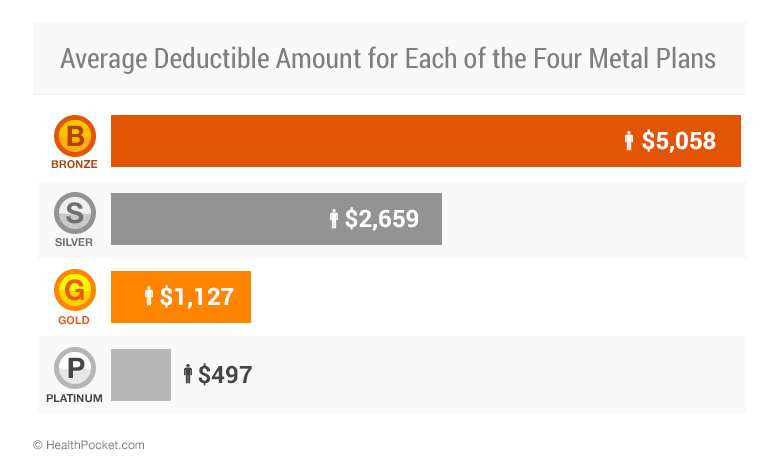

As the table above demonstrates, changes in deductibles and physician

copayments do not change proportionally with the actuarial value changes among

metal tiers.

Conclusion

Available data from the public 2015 rate filings reveal the changes in

out-of-pocket costs are not following a consistent trend among the different

metal plans. Differences in plan actuarial value is not necessarily helpful in

understanding how out-of-pocket costs will differ. However, it is unclear

whether this state of affairs will continue as more states release their rate

filings to the public.

The rate filings process itself is problematic with respect to consumer

transparency. Not all states have released their filings. In order for consumers

to have a meaningful role in the process of American healthcare reform, data

such as health insurance rate filing documents should be made available for

public scrutiny prior to approval of rates. Moreover, a standardization of the

rate filings in a format that allows for easy loading into data analysis tool

would speed the ability of researchers to provide initial data analyses to the

public for their review and potential improvement.

METHODOLOGY

Data in this study regarding health plans was derived from qualified health

plan rate filings within the individual and family health insurance market for

the calendar year beginning January 1, 2015. Cost-sharing data was collected for

bronze, silver, gold, and platinum plans in the individual health insurance

market. Small group, large group. Medicare, and other health plans outside the

individual market were not included in this study. On-exchange stand-alone

dental plans were also excluded from this study. The cost-sharing categories

examined were deductibles, annual limits on out-of-pocket costs, and fees for

doctor and specialist visits. Other cost-sharing categories such as prescription

medication co-payments, Emergency Room charges, or co-insurance fees for major

medical procedures were not included in this study. All out-of-pocket costs

assume covered medical services delivered by in-network healthcare

providers.

Rate filings were gathered from the following states:

- Arizona

- Connecticut

- Indiana

- Maine

- Michigan

- North Carolina

- Rhode Island

- Tennessee

- Virginia

Rate filings must be approved by the state department of insurance and, as

such, may be rejected or may require alteration before final approval is given

to the health plan. Disapproved or withdrawn filings were not included in the

study. When discrepancies existed within the filings, plan attributes entered as

inputs within the actuarial calculations were given privilege.

All out-of-pocket costs assume in-network delivery of covered medical

services and no reduction in cost-sharing due to income-based government

subsidies.

AUTHORS

This analysis was written by Kev Coleman, Head of Research & Data at

HealthPocket, and Jesse Geneson, data researcher at HealthPocket. Additional

data collection and analysis was performed by Katherine Bian. Correspondence

regarding this study can be directed to Mr. Coleman at

kevin.coleman@healthpocket.com.

Kev

Coleman on Google+

Jesse

Geneson on Google+

Sources:

1States were limited to ones that made rate

filings available to the public for review. The states examined were: Arizona,

Connecticut, Indiana, Maine, Michigan, North Carolina, Rhode Island, Tennessee,

and Virginia.

2Kev Coleman and Jesse Geneson. gDeductibles,

Out-Of-Pocket Costs, and the Affordable Care Acth HealthPocket.com (December 12,

2013). http://www.healthpocket.com/healthcare-research/infostat/2014-obamacare-deductible-out-of-pocket-costs

3gFact

sheets: HHS 2015 Health Policy Standards Fact Sheet.h CMS.gov. (March 5, 2014).

http://www.cms.gov/Newsroom/MediaReleaseDatabase/Fact-sheets/2014-Fact-sheets-items/2014-03-05-2.html

4Data

obtained from Healthcare Bluebook. Office visit, established patient, level 2:

$83.https://healthcarebluebook.com/page_ProcedureDetails.aspx?id=224&dataset=MD&g=Office+Visit%2c+Established+Patient%2c+Level+2

Office visit, new patient, complex issue: $387. https://healthcarebluebook.com/page_ProcedureDetails.aspx?id=222&dataset=MD&g=Office+Visit%2c+New+Patient%2c+Level+5

5The

Centers for Medicare & Medicaid services have asserted that Actuarial Value

categories, along with Essential Health Benefits standards, gwill significantly

increase consumersf ability to compare and make an informed choice about health

plansc gMetal levelsh will allow consumers to compare plans with similar levels

of coverage, which along with consideration of premiums, provider networks, and

other factors, help the consumer make an informed decision.h http://www.cms.gov/CCIIO/Resources/Fact-Sheets-and-FAQs/ehb-2-20-2013.html

© 2014 HealthPocket Inc.